Best Of The Best Info About How To Deal With Accruals

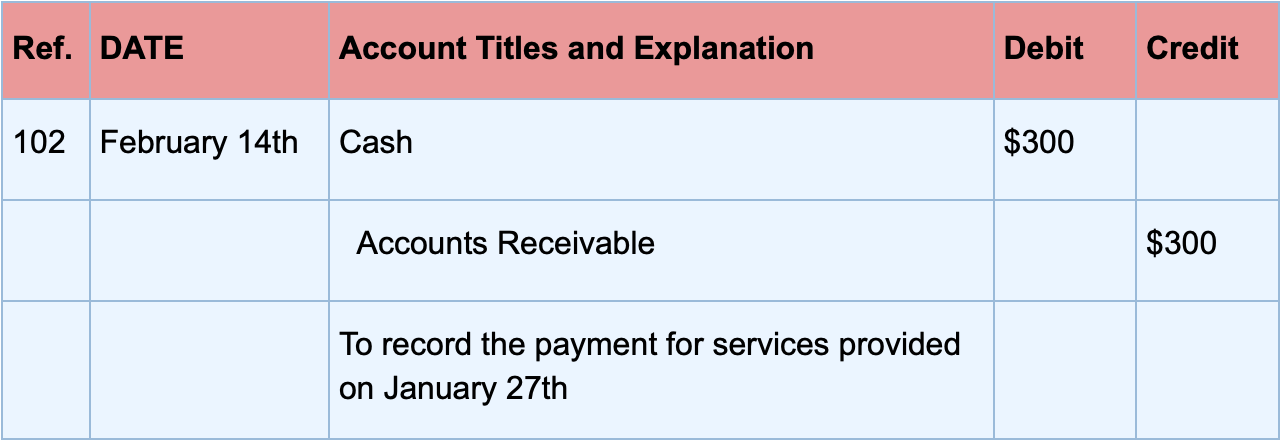

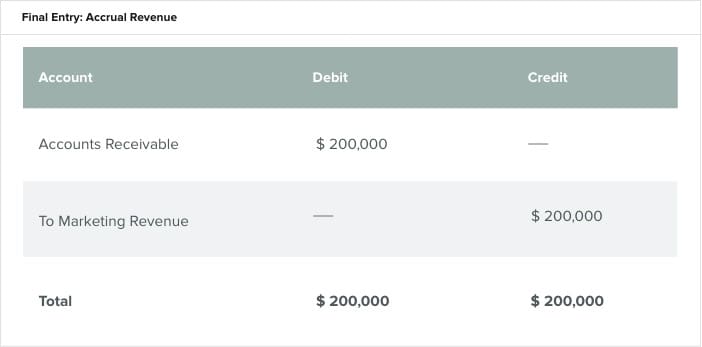

To balance the transaction, a debit in the same amount will be made to an “accounts.

How to deal with accruals. The presence of over accruals can be avoided by only making an accrual entry when the amount to be recorded is easily calculated. There are only two possibilities. You end up with the difference as a.

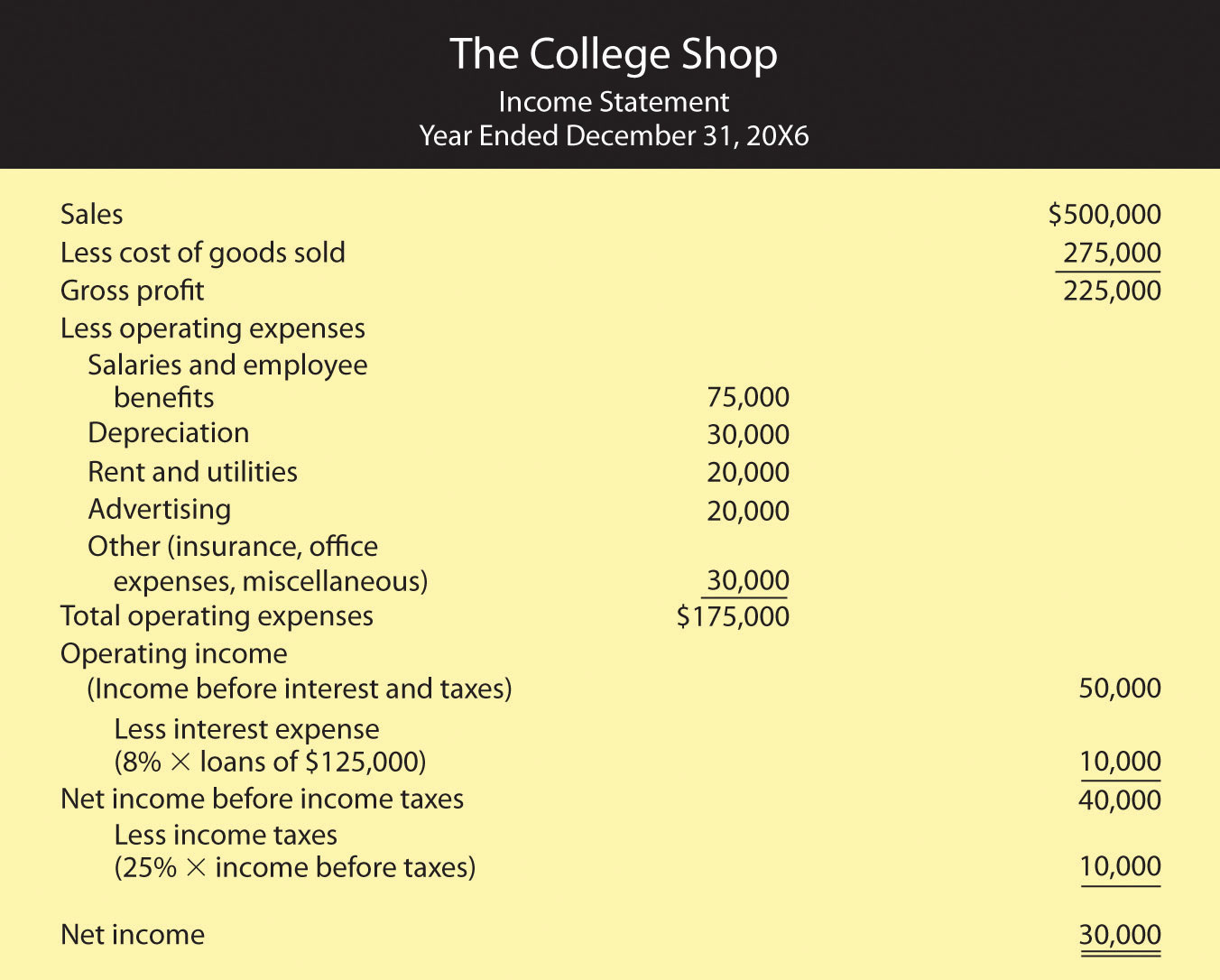

I'm surprised you've not encountered this before. Accruals, accrued expenses, and accrual accounting. Under the accrual basis of accounting, you should record an expense and an offsetting liability for a commission in the same period as you record the sale generated by the.

Although it is easier to use the cash method of accounting, the accrual method can reveal a. It's not really an oversight. Or, avoid the whole problem by having the payroll system automatically generate the cost of the accrual.

May 16, 2022 · how to avoid an over accrual. The accrual principle is used extensively in the business world, but not intuitively clear to everyone. You can deal with it in more than one way (although the end result is obviously the same).

The accrual method requires appropriate anticipation for revenues and expenses. How to avoid an over accrual the presence of over accruals can be avoided by only making an accrual entry when the amount to be recorded is easily calculated. When it comes to accrual accounting, two principles govern it.

Two main accrual accounting principles. A topic related to compensation is the accrual of vacation time. It repeats the accrual process each.

:max_bytes(150000):strip_icc():gifv()/accruals_definition_final_0804-b2460ee1b1a94e928a21a8f31b99c403.png)

/accruals_definition_final_0804-b2460ee1b1a94e928a21a8f31b99c403.png)